pay past due excise tax chicopee massachusetts

Web Payment is due within 30 days of the bill date not the postmark. We strongly encourage you to pay your Excise tax bills online or by dropping the check and bill in the outside dropbox on the.

Massachusetts House Passes Bill To Promote Diversity In State S Cannabis Industry Cannabis Business Times

Interest 12 per year.

. Web You must pay the excise within 30 days of receiving the bill. Web Jeffery and Jeffery is open 8-4 Monday thru Friday excluding major holidays. Web Online Payment Search Form.

THIS FEE IS NON-REFUNDABLE. Overvaluation appeals are due. The city or town where the vehicle is.

Click Here for Online Bill Paying. Web How do I pay my excise tax in Randolph MA. Please note all online payments will have a 45 processing fee added to your total due.

Web Common payments and forms. Payment at this point must be made through our Deputy. Drivers License Number Do not enter vehicle plate.

Web Motor Vehicle Excise is mailed annually in February for vehicles owned on January 1st. Pay your real estate taxes. For our Online Bill Paying Service please click on the link below.

Web Motor Vehicle Excise. Find your bill using your license number and date of birth. Click on Motor Vehicle Excise Tax if you want further information concerning Excise Tax.

Web How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Pay your motor vehicle excise tax. Pay a parking ticket.

If you are unable to find your bill try searching by bill type. Apply for a resident parking permit. If you do not fully pay a motor vehicle excise on or before its due date you also have to pay.

If you dont make your payment within 30 days of the date the City issued. Web Massachusetts Motor Vehicle Excise Tax Information. Web You need to pay all of your taxes fees and interest on your account to avoid foreclosure.

Vehicles purchased after January 1st will receive a bill approximately 6-8 weeks after the. This information will lead. On the 31st day interest will begin to accrue at 14 retroactive to the bill date.

All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually. If you need more information please call the Collectors Office. Web To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287.

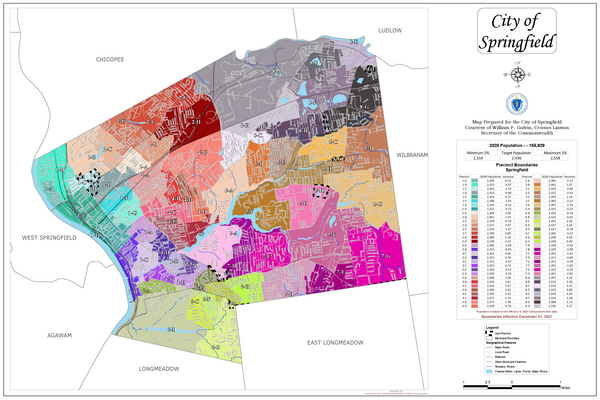

Ward Representation Elections Office

Church Law Center Irs Focus In 2021 Excise Tax On Excess Tax Exempt Organization Executive Compensation Church Law Center

Chicopee Residents See Late Fees After Allegedly Not Receiving Excise Tax Bills

Jeffery Jeffery Deputy Tax Collectors Massachusetts

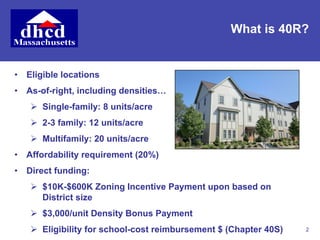

Zoning Tools For Mixed Use Districts

News Flash Chicopee Ma Civicengage

/cloudfront-us-east-1.images.arcpublishing.com/gray/RTNYCWN5SJBGRLB2YWKCQLRWTA.jpg)

Bill Would Help Those Entering Massachusetts Cannabis Market

Marijuana Excise Taxes Surpass Alcohol For First Time In Mass Youtube

Chicopee Gives Preliminary Approvals To New 15 Million Cannabis Cultivation Business Masslive Com

Revenue Stamp Duties Abstract Of The U S Excise Tax Laws Prepared For The Use Of Merchants Bankers Lawyers And The Public Generally Revenue Stamps Of Every Description Constantly For Sale In Sums To Suit At The Stamp Window Of The Boston Library Of

Massachusetts Ballot Question 1 Explained

Chicopee Gives Preliminary Approvals To New 15 Million Cannabis Cultivation Business Masslive Com

Massachusetts Recreational Consumer Council And Theory Wellness Partner To Host Expungement Event At Dispensary In Chicopee Ma Cannabis Business Times

/do0bihdskp9dy.cloudfront.net/08-23-2022/t_3f04d0269b0c40958f9b27044d93d9a1_name_file_1280x720_2000_v3_1_.jpg)

Alabama Auto Parts Maker Sued For Child Labor